Table of Content

However, if you have an excellent credit score, you’ll likely qualify for a loan at a better interest rate. A homeowner loan allows you to borrow up to the amount of equity you have in your property, which means you could borrow as much as your home is worth if you own it outright. You can transfer your existing loan for lower pricing with an option of availing additional top up loan. Complete Guide to FHA LoansConsidering an FHA loan for your new home?

Our mobile app is available to customers aged 11+ using compatible iOS and Android devices and a UK or international mobile number in specific countries. Home improvement loans are available over an extended term, up to 10 years. With a loan from us, you can borrow funds up to £35,000 and repay this over 2 to 7 years.

What are the documents required for a Home Extension Loan ?

After getting an estimate of EMI using the calculator, you can apply for a home loan online from the comfort of your living room easily with Online Home Loans by HDFC. This option provides you the flexibility to increase the EMIs every year in proportion to the increase in your income which will result in you repaying the loan much faster. With our experience of providing home finance for over 4 decades, we are able to understand the diverse needs of our customers and fulfill their dream of owning a home . Home Loan EMI Calculator assists in calculation of the loan installment i.e. It an easy to use calculator and acts as a financial planning tool for a home buyer.

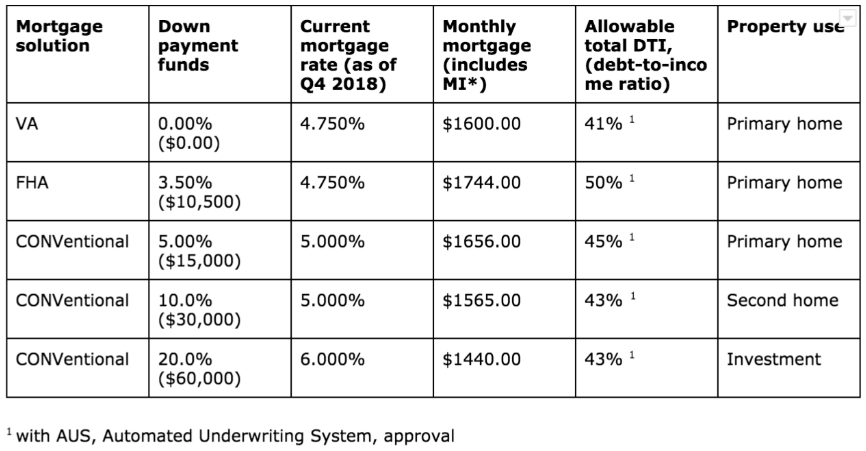

In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. In these examples, the lender holds the deed or title, which is a representation of ownership, until the secured loan is fully paid. Defaulting on a mortgage typically results in the bank foreclosing on a home, while not paying a car loan means that the lender can repossess the car. You are required to pay 10-25% of the total property cost as ‘own contribution depending upon the loan amount. 75 to 90% of the property cost is what can be availed as a housing loan. In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded.

Fees & Other Charges

Our minimum and maximum terms for certain loan amounts are shown below. It was a very straight forward process and really easy to understand. From single story side returns to full kitchen extensions, our home extension loans are designed around your plans. It’s a good idea to know exactly how much the work you’re proposing is going to cost you, so you should ask a few contractors for an estimate. Shop around to get an average price and remember to include a contingency amount for larger jobs.

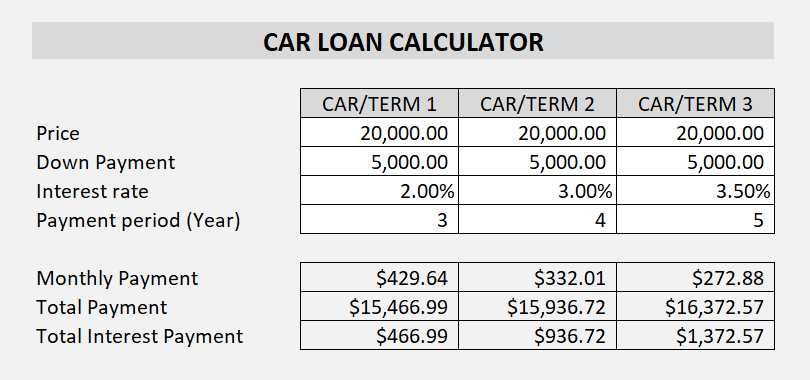

Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment.

Home Extension Loan

As one of the leading Indian Investment Managers, Tata Asset Management Limited understands that managing wealth is as important as the creation of it. View their range of investment solutions for financial planning & wealth creation. Once you’ve registered, select ‘next’ to log in and apply for a loan. It's important for you to understand how we use and share your information. Please read thisshort summarybefore you continue with your application. Before you apply, we need to check you're happy with a few things.

Our tailor made home loans caters to customers of all age groups and employment category. We'll show you how much you could borrow, your personalised interest rate and monthly payments. Of course, the best option for you will depend on your own personal circumstances.

THINK HOME LOANS THINK MOTILAL OSWAL

Avail a loan up to Rs. 2 lakhs through a simple process with minimal documentation. Get flexible tenures up to 36 months and repay your Microfinance loan EMI as per your convenience. Our prompt service ensures you a hassle-free process for quick approval and disbursal of loan. Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc.

Whether you want to expand your business, or you need funds for your personal use, our Loan Against Property will cover all your financial needs. Whether you want to revamp your business, launch a new store, buy new machinery, increase working capital or outperform your competitors. Tata Capital Unsecured Business Loans offer you customised loans to suit your business plan. A marriage today comes with its fair share of frills, thrills and not to mention - Bills.

It’s mandatory that you have a functioning bank account and repayment will be routed through it. The down payment is the money you pay upfront to purchase a home. The down payment plus the loan amount should add up to the cost of the home. Adjust your down payment size to see how much it affects your monthly payment.

Second charge mortgages have a minimum term of 36 months to a maximum term of 360 months. If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay. Our full and final list of documentation is available in a convenient schedule here. HomeFirst understands that proof of income is not always available for self-employed customers, so we find other ways to ensure that you have a steady source of income.

For instance, would it be better to have more in savings after purchasing the home? Compare realistic monthly payments, beyond just principal and interest. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Zillow's mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet.

You can avail a Home Extension Loan for a maximum term of 20 years or till your age of retirement ,whichever is lower. Get the Tata Capital Loan App and Apply for loans, Download Account Statement/Certificates, Track your requests & much more. Get them delivered straight to your device through website notifications. Tata Capital offers Two Wheeler Loans for you to own the bike of your choice.